The Circles UBI Project: Reinventing Money Through Blockchain and Trust

The Circles UBI Project: Reinventing Money Through Blockchain and Trust

Circles 2.0 made its official debut on May 21, 2025, marking a significant evolution in the project’s journey. While I’ve referenced Circles in earlier pieces, this update deserves a closer look, especially considering how radically it reimagines what money can be.

If I had to explain Circles in a nutshell, I’d call it a “people-first alternative to Bitcoin.” Like Bitcoin, it operates with its own digital currency — CRC — and issues new tokens at regular intervals. But rather than being mined through energy-intensive computation every 10 minutes, Circles takes a different path: one CRC is automatically issued to each participant every hour. There’s no proof-of-work involved. Instead, it functions as a kind of algorithmic Universal Basic Income, delivering value directly to individuals by default.

Beyond simply issuing CRC tokens automatically, Circles also includes a built-in mechanism to prevent uncontrolled inflation: over time, each user’s CRC balance gradually decreases. This happens through a daily “burn” of a small percentage of their holdings, which adds up to around 7% per year.

In practical terms, this functions like a demurrage fee or, borrowing a term from economic theory, a type of tax. According to Modern Monetary Theory (MMT), governments don’t need taxes to fund spending; instead, they use taxes to remove money from circulation and help manage inflation. In that sense, Circles’ approach mirrors this logic, which is why the term “tax” feels fitting here.

This annual 7% reduction isn’t just about inflation control. It also serves to level the economic playing field by softening wealth accumulation and helping newcomers avoid being perpetually behind early adopters.

Of course, a natural concern arises: what prevents users from creating fake identities to hoard more CRC? This challenge — often referred to as the Sybil problem — is one many decentralized projects struggle to overcome. Circles tackles it using a decentralized identity framework known as the web of trust.

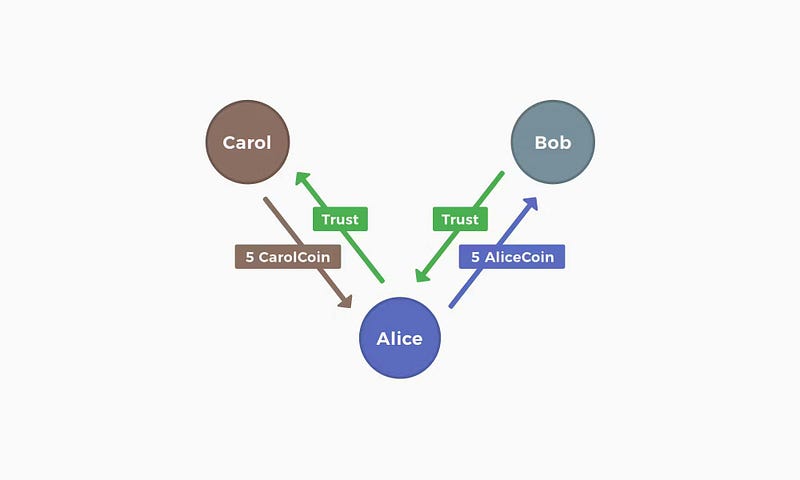

In Circles, every user essentially issues their own personal version of CRC, and others choose whether or not to trust it. So when Alice joins the network, she receives “Alice CRCs,” and Bob receives “Bob CRCs.” If Alice and Bob trust each other, their currencies become mutually exchangeable — Alice will accept Bob’s CRCs, and vice versa.

This model shines when more people are involved. Imagine a third person, Carol, enters the picture. Alice doesn’t know Carol and therefore doesn’t trust her currency. But if Bob trusts Carol and Alice trusts Bob, then the network bridges that trust gap. Carol can swap her CRCs for Bob’s, and then use Bob’s CRCs to pay Alice, for instance, for a haircut. The system handles these indirect trust paths seamlessly in the background, so to Carol, the transaction still feels like a direct payment to Alice.

These automated trust-based routing paths make Circles not just resistant to fake accounts, but also a fascinating experiment in how money might flow in a decentralized, reputation-driven economy.

This scenario highlights one of the most compelling aspects of programmable digital currencies: they enable economic models that would be impossible to manage with physical cash or traditional banking systems. What would be a logistical nightmare in the analog world becomes smooth and automatic thanks to smart contracts and decentralized protocols.

The web of trust also doubles as a clever defense against fake identities. Since users are free to choose whom they trust, there’s a natural disincentive to accept currency from suspicious or fake accounts. Trusting the wrong people weakens your own currency’s standing by making it freely exchangeable with unverified tokens, which could dilute its perceived value.

In this way, Circles embeds a kind of self-regulating immune system into its network. Rather than relying on a central authority to vet identities, the community’s trust decisions collectively enforce quality and integrity, keeping the system robust by design.

On the technical side, Circles leverages the ERC-1155 token standard — a versatile format on the Ethereum blockchain that supports both fungible and non-fungible tokens within a single contract. This allows each participant to have their own uniquely identifiable token type: Alice’s CRCs are distinct from Bob’s, and so on.

By using ERC-1155, Circles ensures that every user’s currency is technically and functionally separate, while still interoperable within the system’s trust-based exchange model. This design choice underpins the entire architecture of personal currencies and makes the web of trust possible at scale.

Another standout component of the Circles ecosystem is the Metri Wallet, a purpose-built crypto wallet designed to make participation simple and accessible. Unlike conventional wallets that often require clunky apps and steep onboarding curves, Metri is a Progressive Web App (PWA) — meaning there’s nothing to download or install. Just visit the website, sign up with your email, and you’re ready to go.

What sets Metri apart is how effectively it abstracts away the technical hurdles that typically intimidate new crypto users, like managing private keys or dealing with gas fees. Instead, the wallet delivers a smooth, intuitive user experience that feels more like a modern fintech app than a blockchain tool.

Under the hood, each Circles user is equipped with a Safe smart account, enabling them to sign transactions using a Passkey instead of a traditional private key. Passkeys are supported by all major browsers and offer strong security, often tied to biometric authentication on mobile devices. This approach makes Circles not only user-friendly but also secure by default, lowering the barrier to entry without compromising safety.

It’s hard to predict how far Circles will go. Years ago, if someone had claimed that a purely digital asset like Bitcoin — with no physical backing, just numbers on a blockchain — would one day be worth thousands of dollars, I probably wouldn’t have taken it seriously. And yet, here we are. This reminds us of an uncomfortable truth: the value of money is ultimately rooted in collective trust. When a group agrees to treat something as money, that shared belief is what gives it real-world utility.

Could the same happen with CRC? It’s possible.

I do have my reservations, particularly around network growth. Will Circles manage to build a vibrant, inclusive community? And how will new users onboard if they don’t already have trusted contacts in the system? These are open questions. Still, I’m cautiously optimistic. With innovations like the Metri Wallet simplifying the user experience and a thoughtful design underpinning the entire system, Circles is a bold and promising experiment in reshaping how we think about value and trust.